Dai market information: price, market cap, and supply

Dai Price is $0.999. Its current circulating supply is 4.56B dai with a market cap of $4.56B.

PRICE

$ 0.999

24h % PRICE

-0.09%

VWAP (24h)

(Not Available)

MARKET CAP

$ 4.56B

24H VOLUME

$ 81.65M

COIN SUPPLY

4.56B DAI

What is Dai (DAI)

DAI is a stablecoin on the Ethereum blockchain, designed to maintain a value as close as possible to one U.S. dollar through a system of smart contracts that manage its supply. The stablecoin is governed by MakerDAO, a decentralized autonomous organization (DAO) where holders of its governance token, MKR, participate in proposing and voting on modifications to key parameters in these smart contracts.

In a 2020 article by Bloomberg, MakerDAO was highlighted as the first decentralized application to achieve substantial adoption.

Overview

DAI operates through a decentralized lending system managed by MakerDAO’s smart contracts. To generate new DAI, users deposit one of the accepted collateral assets—such as Ether—into a smart contract, creating a loan backed by that collateral. The loan’s "collateralization ratio" is determined by the current USD value of the collateral divided by the borrowed DAI amount. This ratio is calculated based on the USD price of the collateral provided by a set of decentralized oracles. Each type of loan has a required minimum collateralization ratio, typically ranging from 110% to 200%. Suppose the collateralization ratio falls below the minimum threshold. In that case, anyone can trigger the liquidation of part of the collateral to repay the debt by selling it for DAI on a decentralized exchange, with a reward given to the account initiating the process. Setting the minimum ratio above 100% provides enough buffer to handle sudden price drops in the collateral asset. In general, lower minimum ratios come with higher interest rates to compensate for increased risk.

When the loan and accrued interest are repaid, the corresponding DAI is destroyed, and the collateral is unlocked for withdrawal. This mechanism ensures that the value of DAI remains backed by the value of the collateral held in MakerDAO’s contracts. Through control over collateral types, collateralization ratios, and interest rates, MakerDAO can influence the supply of DAI, helping to maintain its value.

Holders of MKR tokens have the ability to propose and vote on changes to these variables. The voting power is proportional to the amount of MKR held. Additionally, the MKR token serves as an investment in the system, as a portion of the interest paid on loans is used to buy back MKR from the market and "burn" it, reducing its total supply. This mechanism is designed to make MKR deflationary, tied to the revenue generated from DAI lending.

MakerDAO was founded in 2014 by Danish entrepreneur Rune Christensen, who derived the name from the Chinese character 貸, which he interpreted as “to lend or to provide capital for a loan.”

DAI was officially launched on the Ethereum mainnet on December 18, 2017. During its first year, DAI successfully maintained its target value close to one U.S. dollar, even as the price of Ether—its only collateral at the time—plummeted by more than 80%.

In September 2018, venture capital firm Andreessen Horowitz made a $15 million investment in MakerDAO, acquiring 6% of all MKR tokens.

The Maker Foundation was established in 2018 in Copenhagen to support the ecosystem, funding projects like developing essential code for the platform’s functionality and evolution.

In 2019, MakerDAO faced an internal conflict regarding increased integration with traditional finance. Christensen advocated for stricter regulatory compliance to allow assets beyond cryptocurrencies to be used as collateral for DAI, leading to a significant departure, including the exit of MakerDAO’s CTO.

History

MakerDAO was established in 2014 by Rune Christensen, who took inspiration from the Chinese character 貸, translating it as “to lend or to provide capital for a loan.”

The DAI stablecoin launched on December 18, 2017, on the Ethereum network. During its first year, despite Ether’s significant price drop, DAI consistently held its value near one U.S. dollar.

In September 2018, venture capital firm Andreessen Horowitz invested $15 million in MakerDAO, securing a 6% stake in MKR tokens.

In 2018, the Maker Foundation was created in Copenhagen to support various projects within the MakerDAO system, such as developing and maintaining the platform’s code.

In 2019, a debate within MakerDAO arose over how closely the project should align with traditional financial systems. Christensen pushed for more regulatory compliance to expand collateral options beyond cryptocurrency, which led to internal disagreements and the resignation of the CTO.

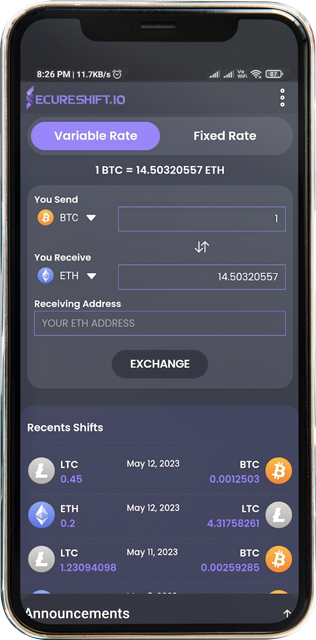

Swap Dai (DAI) for any asset from our extensive crypto selection by following these simple steps:

1. Select DAI as the "You Send" currency.

2. Choose the asset you’d like to receive in exchange for your DAI.

3. Enter the wallet address for the asset you wish to receive.

4. Send your deposit to a unique one-time address.

5. Receive your exchanged coins in approximately 5 minutes!

Top cryptocurrencies to exchange with Dai (DAI)

| # | DAI to | Pair | Available for exchange |

|---|---|---|---|

| No data found! | |||

Why exchange Dai on SecureShift

- Using SecureShift is safe and reliable. As a non-custodial service, we never store or hold your assets.

- SecureShift ensures rapid transactions, typically completing within two minutes.

- Our platform is highly versatile. We continuously strive to enhance our services, satisfy our customers, and broaden our cryptocurrency offerings.

- No registration is required to trade any crypto asset on SecureShift. All you need is a wallet address.

- Trade freely with no upper limits! Whether your transactions are small or large, we guarantee successful completion every time.

Best Dai (DAI) wallets

Dai (DAI) FAQ

You can easily buy or swap XMR on the SecureShift homepage using any of the 1300+ available cryptocurrencies listed at the top of the page. Simply fill out the transaction details to view Monero's current exchange rate. Additionally, purchasing Monero with fiat currency is available on our main website.

On our platform, you can easily swap JUICE for DAI. Additionally, you have access to over 1,300 available cryptocurrencies for exchange.

Latest News

Today’s crypto market trends and key developments (as of 24 September 2025)

Stock market information for Bitcoin (BTC) The price is 112685.0 USD currently with a change of -426.00 USD (-0.00%) from the previous close. The intraday high is 113223.0 USD and the intraday low is 111370.0 USD. Stock market information for Ethereum (ETH) The price is 4179.31 US...

Sep 24, 2025

How to Mine Monero (XMR): A Simple Guide

Table of Contents What is Monero? What Does Mining Mean? Why Monero is Special What You Need to Start Step 1: Install a Monero Wallet Step 2: Download Mining Software Step 3: Join a Mining Pool Step 4: Configure XMRig Step 5: Start Mining How Much Can You Earn in XMR? Tips...

Sep 24, 2025

Crypto news digest for September 10, 2025

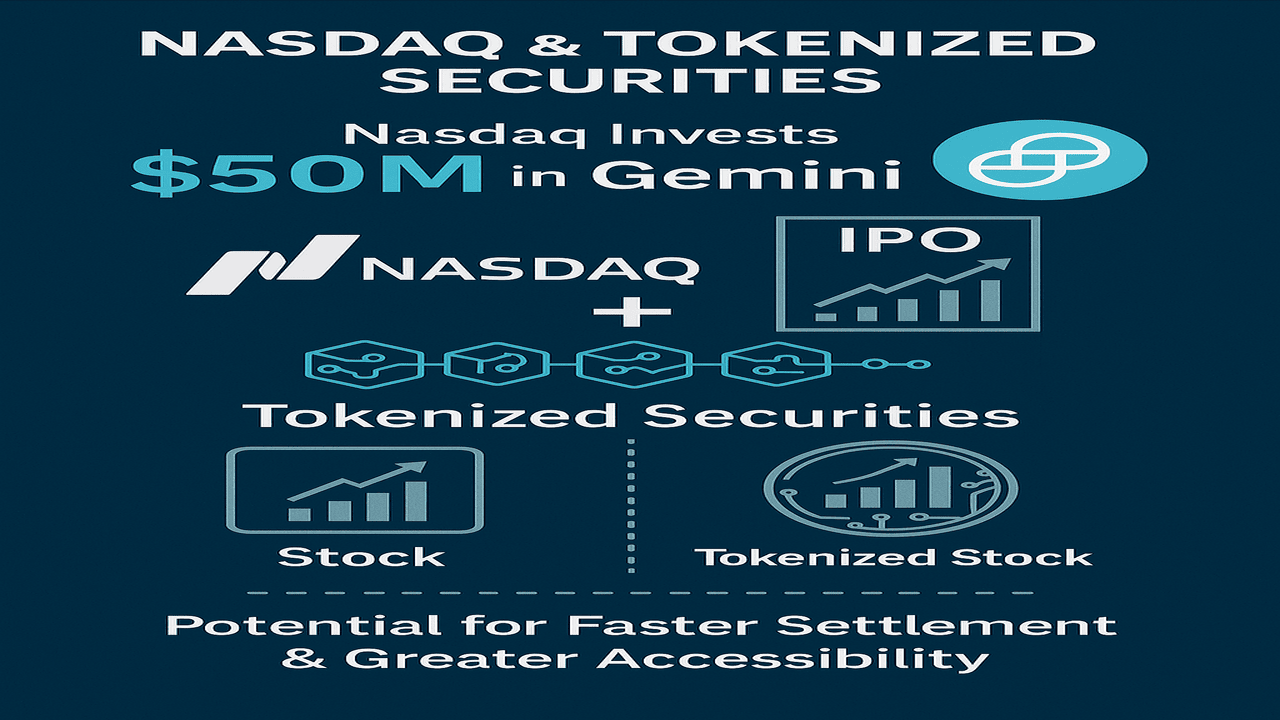

Market Movers & Token Highlights Nasdaq invests $50M in Gemini and backs tokenized securitiesNasdaq is making a major play into blockchain by injecting $50 million into Gemini, tied to Gemini’s upcoming IPO aiming to raise over $300 million. Additionally, Nasdaq filed with the SEC to enable t...